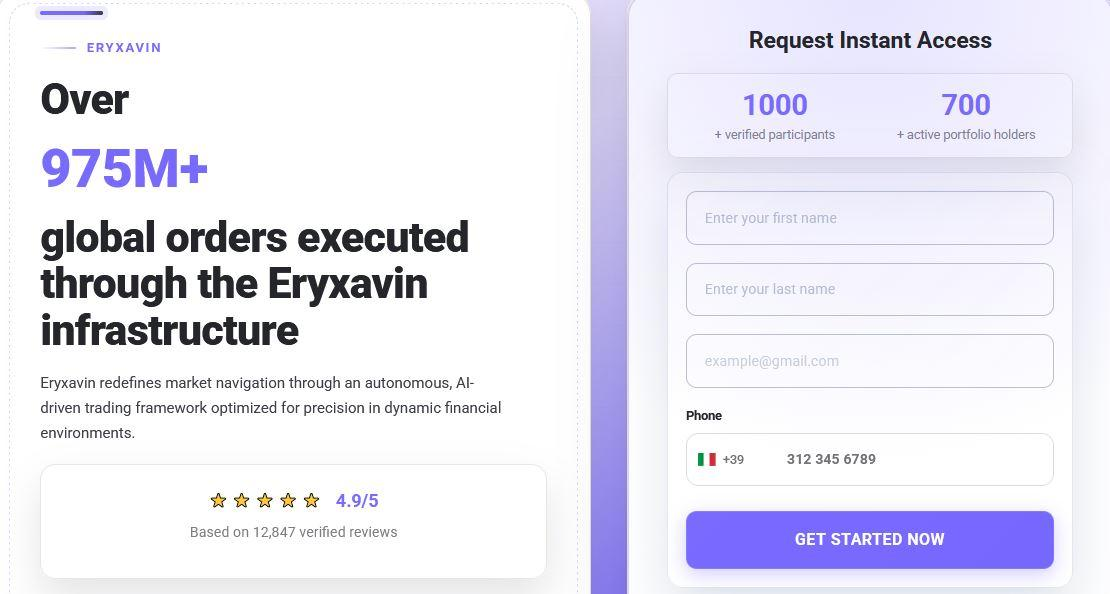

In the rapidly maturing landscape of digital finance, Eryxavin has established itself as a robust, multi-asset trading environment designed to serve both the retail participant and the seasoned market strategist. By 2026, the platform will have become a focal point for discussions regarding integrated AI analysis, security-first architecture, and cross-market accessibility.

This expert review provides a detailed, neutral analysis of Eryxavin’s operational framework, technological integrations, and user protocols to assist traders in making data-driven decisions.

Introduction to Eryxavin Crypto Trading Platform:

Eryxavin functions as an AI-driven cryptocurrency trading platform that monitors markets 24/7 and delivers real-time signals and insights. It supports manual and automated trading modes across hundreds of crypto assets, forex, CFDs, and more, with a user-friendly interface suitable for beginners and intermediates. The platform connects users to trusted brokers, emphasizing security through end-to-end encryption and regulatory compliance.

Free registration and a demo account allow testing without financial commitment, followed by a $250 minimum deposit to activate live features. Withdrawals process quickly, often within 24 hours, supporting cards, transfers, and e-wallets. As of January 2026, Eryxavin maintains positive user feedback for its speed and accessibility, though traders must verify official sites amid imitation risks.

The Architecture of Eryxavin: A Modern Trading Overview

Eryxavin is engineered as a comprehensive hub for diverse financial instruments. Unlike platforms that restrict users to a single asset class, Eryxavin bridges the gap between traditional finance (TradFi) and decentralized assets.

Strategic Asset Support

The platform’s liquidity and execution algorithms are optimized for several key markets:

-

Cryptocurrencies: High-volume pairs including BTC, ETH, and emerging DeFi tokens.

-

Forex (Foreign Exchange): Access to major and minor currency pairs with a focus on trend stability.

-

Traditional Equities: Trading in global stocks and indices.

-

Commodities & Derivatives: Instruments covering gold, oil, futures, and bonds.

Technical Features and Algorithmic Intelligence

The core differentiator for Eryxavin in 2026 is its reliance on Quantum-Logic Engines and AI-driven market insights. These tools are designed to filter through “market noise” to provide actionable data.

1. 24/7 AI Market Surveillance

The platform utilizes specialized algorithms that scan global markets around the clock. Unlike rule-based bots that follow rigid parameters, Eryxavin’s AI adjusts to shifting volatility, ensuring that signals remain relevant during sudden market pivots.

2. Advanced Charting & Indicators

For technical analysts, the dashboard provides a high degree of customization:

-

Indicator Suite: Native support for RSI, MACD, Bollinger Bands, and Fibonacci retracements.

-

Visual Analysis: Multi-timeframe viewing and interactive drawing tools.

-

Real-Time Data: Low-latency price feeds to minimize slippage during trade execution.

3. Risk Management Protocols

Eryxavin prioritizes capital preservation through several automated “fail-safes”:

-

Precision Stop-Loss/Take-Profit: Orders that execute at millisecond speeds when targets are hit.

-

Position Sizing Calculators: Tools to help users align their exposure with their specific risk tolerance.

-

Volatility Scaling: The ability for the system to automatically adjust strategy intensity during “black swan” events.

How Eryxavin Works: Step-by-Step Guide

- Account Setup Process

Begin with a free signup on the official Eryxavin site, entering basic details for instant access. Verify identity if required for compliance, then fund via a $250 minimum deposit using secure methods.

- Exploring Demo Trading

Activate the demo account to practice with virtual funds mirroring real markets. Test AI signals and bot settings without exposure to losses. This builds familiarity with interface navigation and signal interpretation.

- Configuring Automated Trading

Select assets and parameters like risk tolerance, trade size, and stop-loss levels. The AI bot executes based on algorithms tracking trends and volumes. Monitor via dashboard; override manually as needed during events like crypto halvings.

- Manual Trading Execution

Use live charts for technical analysis, applying signals to place orders. Tools support scalping, swing trading, or long-term holds. Adjust positions with real-time data for responsive decision-making.

Deposits and withdrawals incur no platform fees, though processing times vary by method.

Security Framework: Protecting Digital Sovereignty

Security is the primary concern for any digital asset trader. Eryxavin employs a multi-layered security stack to safeguard user data and financial assets.

Data Protection & Encryption

The platform utilizes military-grade AES-256 encryption for all data at rest and in transit. This ensures that personal information and transaction logs are inaccessible to unauthorized third parties.

User Account Security

-

Multi-Factor Authentication (MFA): Integration with SMS, email, and authenticator apps (e.g., Google Authenticator).

-

Session Management: Automatic timeouts for inactive sessions to prevent unauthorized physical access.

-

Biometric Integration: Support for fingerprint and facial recognition on mobile devices.

Financial Compliance

Eryxavin adheres to international regulatory standards to ensure a transparent environment:

-

KYC (Know Your Customer): Standard identity verification for all new accounts.

-

AML (Anti-Money Laundering): Continuous monitoring to prevent illicit financial activities.

-

Fund Segregation: User capital is held in accounts separate from the company’s operational funds.

Advanced Crypto Trading Strategies on Eryxavin Platform:

Eryxavin’s tools support expert-level approaches amid crypto’s volatility. Strategies leverage AI for precision without emotional bias.

- Scalping for Short-Term Gains

Execute numerous small trades on minor price fluctuations. Eryxavin’s fast signals and low-latency execution suit this high-frequency method. Ideal for liquid pairs like BTC/USDT; set tight stop-losses to cap risks.

- Trend Following with AI Insights

Identify uptrends or downtrends via algorithm predictions. Hold positions until reversal signals, diversifying across ETH and altcoins. Backtest on demo to validate against historical data.

- Arbitrage Opportunities

Exploit price differences across exchanges via multi-broker connectivity. Eryxavin’s real-time monitoring flags discrepancies for quick action.

Technical Analysis Tools in Eryxavin Platform:

Eryxavin integrates charting with indicators like RSI, MACD, and Bollinger Bands for crypto patterns. Candlestick visuals and volume overlays aid in spotting reversals or continuations.

Customize dashboards for multi-timeframe views (1m to 1D). AI overlays suggest entry/exit based on historical patterns. Export data for external backtesting enhances strategy depth.

User Experience: From Registration to Execution

The platform’s workflow is designed to reduce the “entry barrier” for beginners while maintaining the depth required by professionals.

Onboarding Steps

-

Account Creation: Users provide basic contact details through the official portal.

-

Verification: Completion of identity checks to unlock full withdrawal limits.

-

Capitalization: Funding the account with an initial deposit (typically starting at €250).

-

Strategy Selection: Traders can choose between manual execution or utilizing AI-assisted tools.

Performance Tracking

The Eryxavin dashboard offers a “Transparency Log,” where users can view:

-

Historical trade performance.

-

Live profit/loss tracking.

-

Exposure analytics across different asset regions.

Risk Management Essentials:

Crypto trading demands strict protocols. Eryxavin’s stop-loss and take-profit automate protection. Never risk over 1% of capital per trade; use trailing stops in bull runs.

Account for leverage risks in CFDs, where 1:100 ratios amplify losses. Diversify to avoid single-asset wipeouts. Monitor drawdowns via portfolio analytics.

External factors like hacks or flash crashes underscore demo practice.

People Also Ask: Eryxavin FAQs

Q. Is Eryxavin legitimate for crypto trading?

Eryxavin shows legitimacy through encryption, quick payouts, and positive reviews (4.8/5 expert ratings). Use official sites only; test with a demo first.

Q. Is Eryxavin suitable for individuals with no trading experience?

Yes. The platform is designed with an intuitive interface and offers automated insights. However, new traders are encouraged to utilize the educational resources provided to understand market risks.

Q. What are the costs associated with the platform?

Eryxavin is known for its transparent fee structure. Most reviews indicate a minimum entry point of €250, with no hidden commissions on trades, though spreads may vary depending on market liquidity.

Q. Can beginners use Eryxavin effectively?

Beginner-friendly with automation, education, and signals; demo aids learning curve.

Q. Can I trade on my smartphone?

Absolutely. Eryxavin is fully responsive on mobile browsers and offers a dedicated application for both Android and iOS, providing the same security features as the desktop version.

Q. How does the withdrawal process work?

Withdrawals are initiated through the user dashboard. Due to security protocols and fund segregation checks, processing times generally range from 24 to 48 hours, depending on the chosen method.

Q. Does the platform guarantee profits?

No. Trading in financial markets involves inherent risk. While Eryxavin provides advanced tools to mitigate risk and identify trends, no platform can guarantee a specific return on investment.

Final Assessment: The Role of Eryxavin in 2026

Eryxavin stands as a testament to the integration of AI within the financial sector. By focusing on accessibility, security, and multi-asset depth, it offers a comprehensive solution for those looking to manage a modern portfolio. While the tools are advanced, the platform remains a neutral vehicle for trade execution, placing the ultimate strategic decisions in the hands of the user.